There’s an ocean of oil profits out there.

Now, I understand the media narrative is that all of these oil profits are being funneled straight into the pockets of Big Oil.

I get it.

It’s an easy narrative to piggy-back onto, isn’t it?

After all, Exxon alone posted a quarterly profit recently of $17.9 billion! To put a little more perspective on that number, that’s a higher quarterly profit than any public oil company has reported in history!

Meanwhile, Chevron hauled in a nice catch of $11.6 billion, and Shell reported profits of $11.47 billion.

Even BP posted $8.45 billion.

Make no mistake, dear reader, the old Seven Sisters were smiling pretty this whole summer.

But they weren’t the happiest ones in the room.

Massive national oil companies (which dwarf the public integrated oil companies) like Saudi Aramco saw year-over-year profits explode 90% higher during the second quarter of the year!

The Saudi kingdom raked in a cool $88 billion during the first half of 2022.

But here’s my only question: Have you drunk your fill yet too?

I hope not, because things are starting to get interesting.

For most investors, 2022 has been an utter disaster to their portfolios… most.

You and I both know that the energy sector has helped individual investors like us turn one helluva profit this summer.

Energy stocks have been ripping higher all year, and even the waning summer driving season (which officially ends after Labor Day weekend) isn’t enough to scare them.

As I sit here today, Brent crude has popped back over $100 per barrel. WTI crude isn’t far behind and is making another run back into triple-digit territory.

What has become crystal clear is that these oil profits are poised to run again.

Sure, we have the SPR releases coming to an end in October, just in time to make a few commercials for the midterm elections.

Of course, there’s also the mysterious case of the EIA’s demand numbers, which suggest that gasoline demand is at a 20-year low, despite the fact that refiners are using up more crude than they were last year.

Even our crude production fell by 100,000 barrels per day last week compared with the previous week.

Like I said, things are going to get interesting over the next few months.

One reason is due to the fact that the United States has become the world’s personal gas station.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

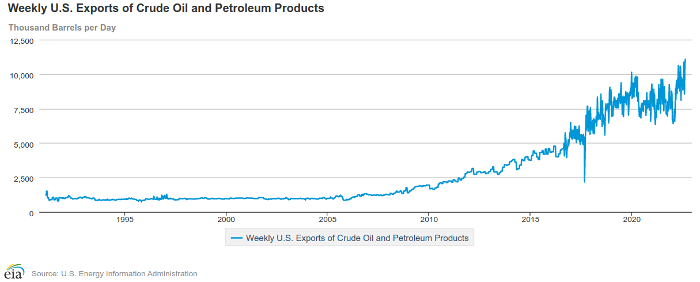

The U.S. exported 11 million barrels per day of crude oil and petroleum products. More than 4 million bbls/d of crude and 6.9 million barrels per day of finished products were sold to foreign countries.

Take a look for yourself:

It’s clear the world is getting its crude addiction back on track in a post-COVID world.

Last year, the nine largest oil-consuming countries on the planet saw demand rise, most notably the 20% jump here in the United States and the 16% increase in China.

But again, these extraordinary profits aren’t just filling Big Oil's and NOCs’ pockets.

Investors like us have a front-row seat as well.

More importantly, I want you to have the same access to the profits that Exxon, Chevron, and even Saudi Aramco do.

This investment report is your first step.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.